The Kingdom Coin Actively Managed Yield Generation.

AMM liquidity pools used by today’s leading DEXs reduce or remove the need for a centralized entity, and as a result, they require a sustained outside source of liquidity to function properly.

Succeeding in the financial industry generally requires effective ways to leverage existing capital, to that extent which DeFi users can engage with decentralized lending, yield generation, and governance. Yield farming can generate passive returns on holdings using decentralized finance (DeFi) protocols — but participating in it is very rarely a passive endeavor.

The kingdom will execute complex strategies, moving crypto assets between platforms to maximize liquidity and returns.

While it can be lucrative, it requires a thorough understanding of protocols to be successful, decentralized finance projects incentive users to contribute to the network's liquidity and stability, since these projects do not rely on a centralized market facilitator acquiring knowledge of how Yield Farming works can be intimidating and needs to be approached with caution.

Revenue handling

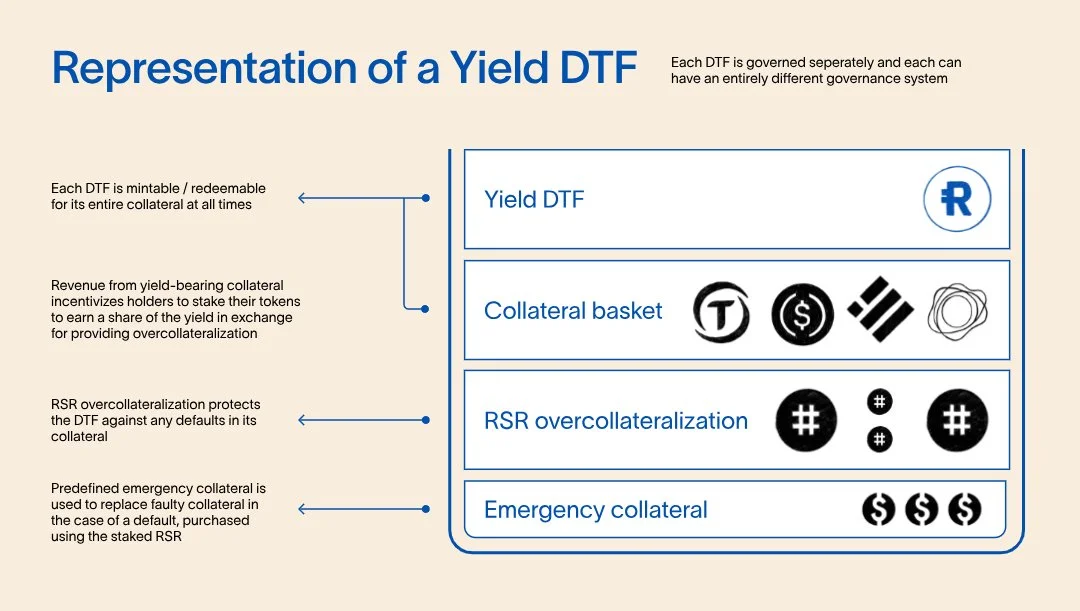

Yield‑bearing collateral—such as interest‑bearing tokens or LP positions—accrues value over time. The protocol’s Backing Manager periodically harvests this surplus and converts it into liquid assets.

Kingdom Community DAO governance determines how the harvested revenue is divided among three outlets: Token holders, RSR stakeholders, and Helping Hands Community - Funds specified by governance.

Initial Yield DTFs will likely have relatively simple governance systems, which will probably evolve over time. That evolution is up to those that hold power in the initial governance systems.

Governance defines not just the basket to back a Yield DTF, but also an ordered list of emergency collateral. Staked RSR can earn rewards, based on three factors:

The amount of revenue the DTF generates

The portion of revenue that governance has directed to RSR stakers

Your portion of the total RSR staked on that DTF

As a simple example, suppose (these numbers are just made up for simplicity, to make the arithmetic clear):

A fictional DTF generated $100 in revenue in a period

20% of revenue was designated for RSR stakers

1000 total RSR was staked

You had staked 100 of the total 1000 RSR that is staked

In this simple example, you would get $100 * 0.2 * (100/1000) = $2 for that period.